The Savior Bill for more than 7 Million Borrowers

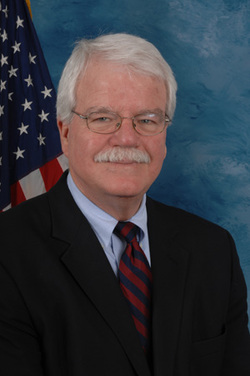

What Miller is proposing will be a big helps on the 7 million borrowers the average of $1000 stating: “Last month, House Republicans voted for a budget that relies on hiking student loaninterest rates, while this month they voted to cut taxes again for millionaires and billionaires. I urge them instead to join me and my Democratic colleagues in standing up for students by stopping the hike. The clock is ticking. The time to act is now.”

Presidents Raise the Topic in His 2012 State of the Union Address

Regarding the student loan, the president Barack Obama first raised the topic on his 2012 State of the Union Address, where the Republicans rate down the three-swing-state trip as he tried to appeal to the young voters. President Obama expressed to college reporters:” For sometimes now, I’ve been calling on Congress to take the steps to make higher education more affordable, to prevent these interest rates from doubling, and to extend the tuition tax credit that has saved middle-class families millions of dollars, but also, to double the number of work/study jobs over the next five years.”

RSS Feed

RSS Feed